The American Legislative Exchange Council (ALEC) has updated its Rich States, Poor States index in 2023, which analyzes the economic competitiveness of each state. Alaska ranks 23rd nationwide for its middling economic outlook, serving as a reminder for the state to implement policies that help Alaskans thrive. The index highlights several areas where the state excels — such as the absence of a personal income tax or statewide sales tax — while signaling some areas of improvement.

The American Legislative Exchange Council (ALEC) has updated its Rich States, Poor States index in 2023, which analyzes the economic competitiveness of each state. Alaska ranks 23rd nationwide for its middling economic outlook, serving as a reminder for the state to implement policies that help Alaskans thrive. The index highlights several areas where the state excels — such as the absence of a personal income tax or statewide sales tax — while signaling some areas of improvement.

Alaska’s economic outlook, a forward-looking projection, ranks 23rd nationwide based on 15 equally weighted policy variables. These include the top marginal personal income tax rate, the top marginal corporate income tax rate, personal income tax progressivity, property tax burden, sales tax burden, remaining tax burden, estate/inheritance taxes, recently legislated tax changes, debt service as a share of tax revenue, share of public employees, state liability system, the state minimum wage, the average workers’ compensation costs, whether it is a right-to-work state, and tax expenditure limits.

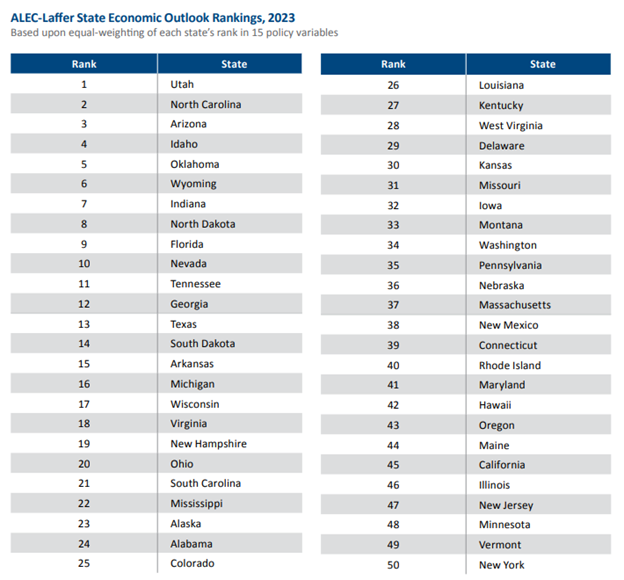

In comparison to the 2022 ranking, Alaska’s economic outlook has declined from 21st to 23rd nationwide in 2023. The top three states with the most optimistic economic outlooks are Utah, North Carolina, and Arizona, while New York, Vermont, and Minnesota are the least optimistic. Figure 1 shows the economic outlook ranking of all 50 states.

One of Alaska’s strengths is its lack of a personal income tax, earning it first place for its 0% tax rate and second place for its progressivity. However, Alaska has one of the highest top marginal corporate income tax rates of 9.40%, placing it at 43rd. Alaska’s complicated and burdensome ten-bracket system also has adverse effects on the state’s overall economic competitiveness.

The tax burden in Alaska paints a mixed picture. Although the state has a low sales tax burden of only $5.35 per $1,000 of personal income, ranking 5th, this is due to the absence of a statewide sales tax and localities being allowed to impose their own sales taxes. However, Alaska relies heavily on property taxes, ranking 40th for its property tax burden of $36.38 per $1,000 of personal income. The remaining tax burden from other sources in Alaska is only $13.68 per $1,000 of personal income, ranking 12th nationally. Alaska does not levy any state estate or inheritance taxes, thus lightening the tax burden in comparison to other states.

One concerning aspect of Alaska’s economy is its high number of state and local public employees, ranking 49th nationally, and one place lower than the 2022 index. For every 10,000 people in Alaska, there are 687.3 public employees. A large public workforce may divert resources away from the private sector, which is essential for driving economic growth.

Additionally, Alaska’s debt-payment-to-tax-revenues ratio is the worst in the country at 11.16%. This means that the state’s ability to invest in current or future projects is stretched thin by the high interest payments on debt. This is notably worse than the 2022 index, which posted a ratio of 8.86%.

Although ALEC ranks Alaska 3rd for its tax and expenditure limit, the true situation is different. As Alaska Policy Forum has previously noted, the state’s expenditure limit is set so high that it has little impact on government spending. Implementing a more meaningful spending cap is necessary for responsible fiscal management.

When considering past economic performance, Alaska ranks 49th in the nation, only surpassing Louisiana. ALEC’s economic performance measure considers cumulative GDP growth, domestic migration, and non-farm employment growth in the past decade. Alaska ranked dead last in terms of cumulative GDP growth, with only 0.8% between 2011 and 2021. Domestic migration saw a cumulative loss of 70,550 people between 2012 and 2021, placing Alaska 34th nationwide. The state has experienced a net outmigration annually for the past decade. Non-farm employment also declined by 5.47%, ranking 49th nationwide.

Alaska’s economic outlook ranking would not be nearly so rosy if the state implemented a personal income tax or statewide sales tax, as their absence contributes much to ALEC’s rankings. High maximum corporate tax rates, a large public workforce, and excessive debt service obligations have hindered Alaska’s economic growth.

To unlock the state’s economic potential, policymakers should take meaningful steps, such as setting a more effective spending cap, maintaining a low overall tax burden, reducing debt service obligations, and implementing policies that promote private job growth.