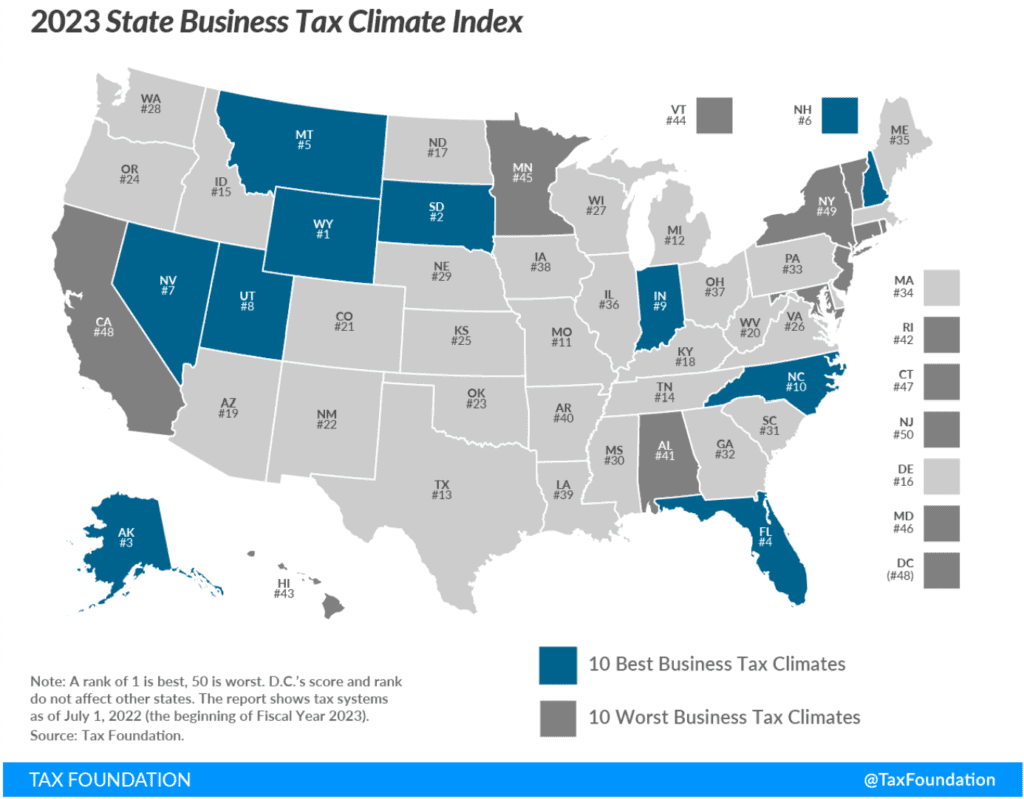

Alaska again ranks in the top three states for having business-friendly taxes. The Tax Foundation’s 2023 State Business Tax Climate Index ranked states based on the economic impact their respective business taxes have on private enterprises. Alaska scored third best in the overall category, behind only Wyoming and South Dakota. This is the sixth year that Alaska has ranked third best business tax climate in the country.

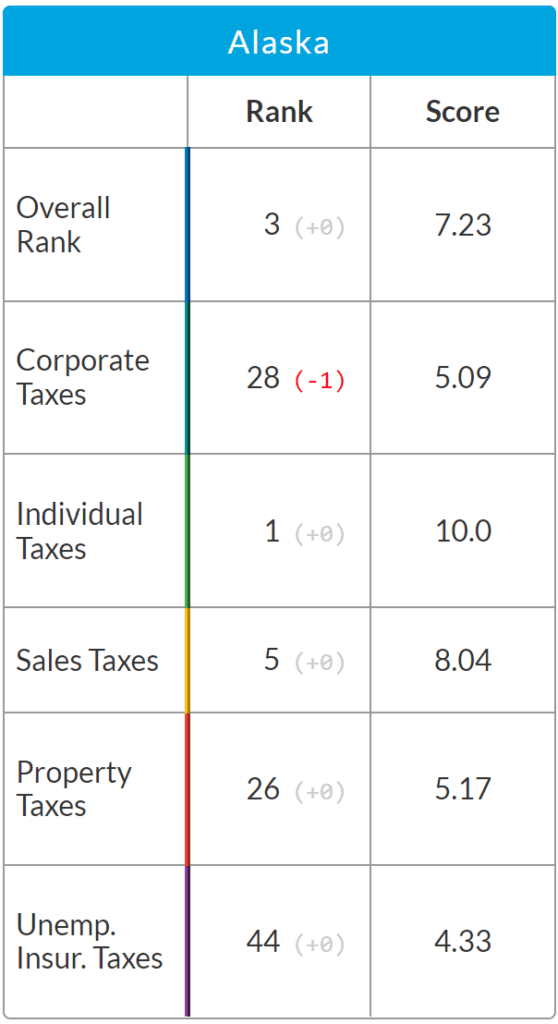

The Tax Foundation index has five individual categories: corporate taxes, individual taxes, sales taxes, property taxes, and unemployment insurance taxes. Scores on a 1-10 scale are made based on a state’s tax burden in relation to other states. States that do not have a system of taxation in one of the categories are automatically given a score of 10 in that category, the highest possible score.

The five categories are not equal. Their weights are as follows: individual income tax is weighted 30.5%, sales tax 24%, corporate tax about 21%, property tax almost 15%, and finally unemployment insurance tax 9%. The aggregated score from these categories is compared to the average scores of all fifty states.

The five categories are not equal. Their weights are as follows: individual income tax is weighted 30.5%, sales tax 24%, corporate tax about 21%, property tax almost 15%, and finally unemployment insurance tax 9%. The aggregated score from these categories is compared to the average scores of all fifty states.

Larger differences between states are more likely to impact business decisions. For instance, a one percent difference between states might not lead to a company moving its headquarters and factories to a higher-scoring state but a 10 percent difference makes a move more likely.

As the Tax Foundation explains, its yearly index is put together “to show how well states structure their tax systems” as a way to “provide a road map for improvement.” Although Alaska’s current ranking did not shift from last year’s ranking, a deeper examination of the state’s score shows places where Alaska can improve.

Alaska’s third-place ranking is due to having no statewide income or sales tax. As mentioned in the index, most of the top 10 states do not have a major tax. Indiana and Utah are the exceptions.

When it comes to corporate, property, and unemployment insurance taxes, however, Alaska ranks middling or poor, as these taxes have a large impact on small businesses and business growth.

Alaska’s tax ranking is propped up by the fact that it does not have a state income tax. And it should stay that way. Additional research by the Tax Foundation and The Buckeye Institute both show that implementing a statewide income tax would be economically harmful to Alaskans.