By Quinn Townsend

Introduction

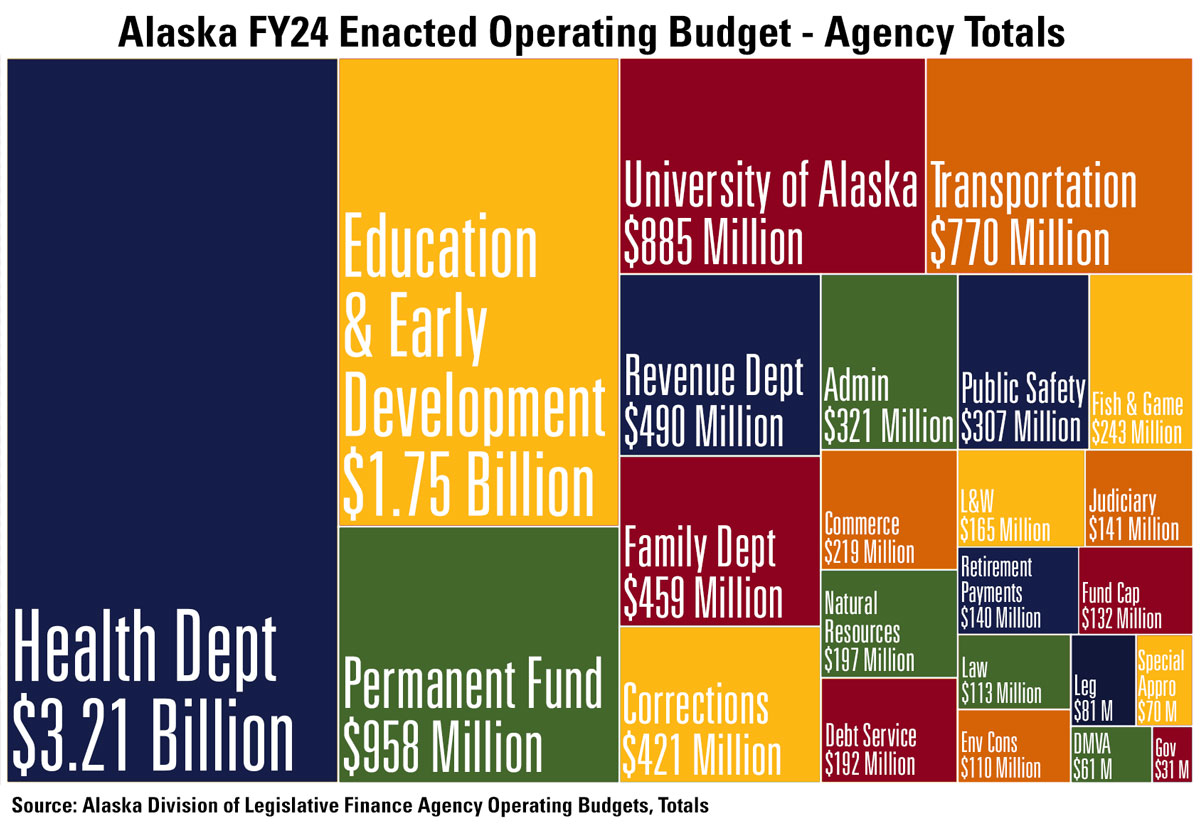

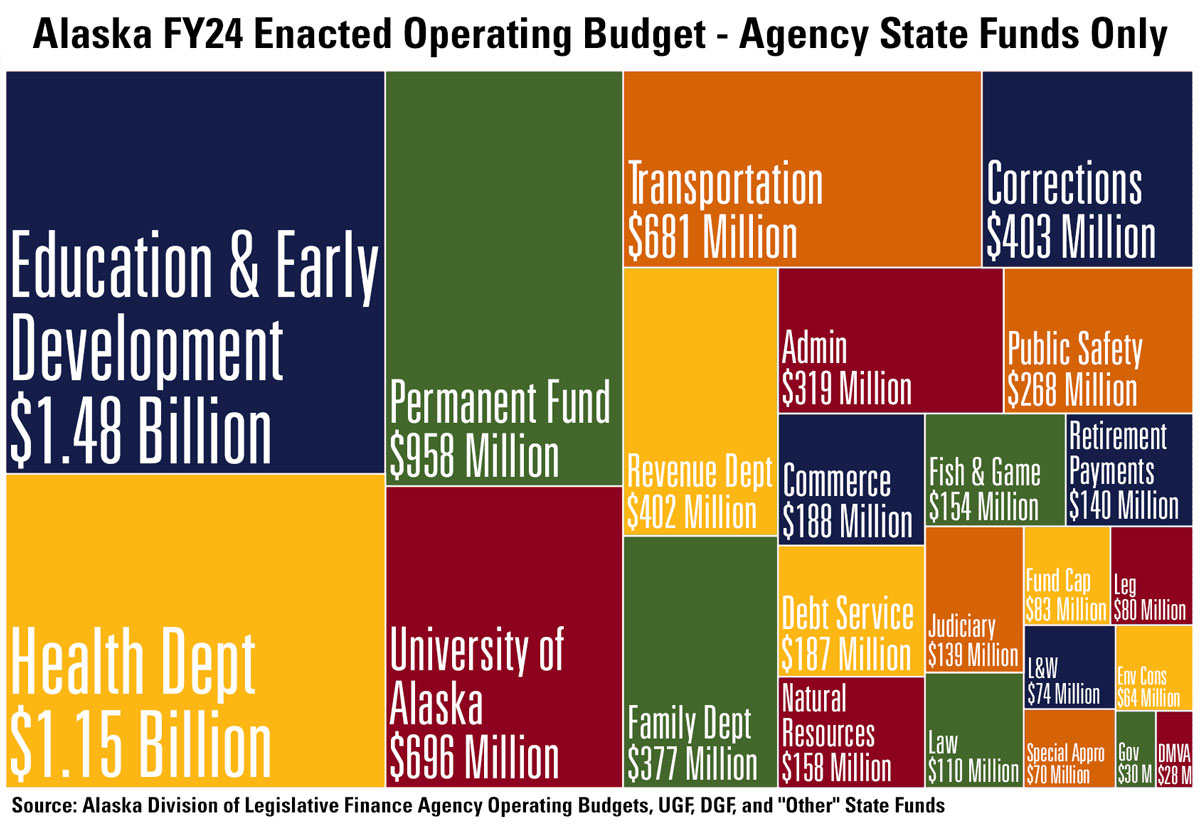

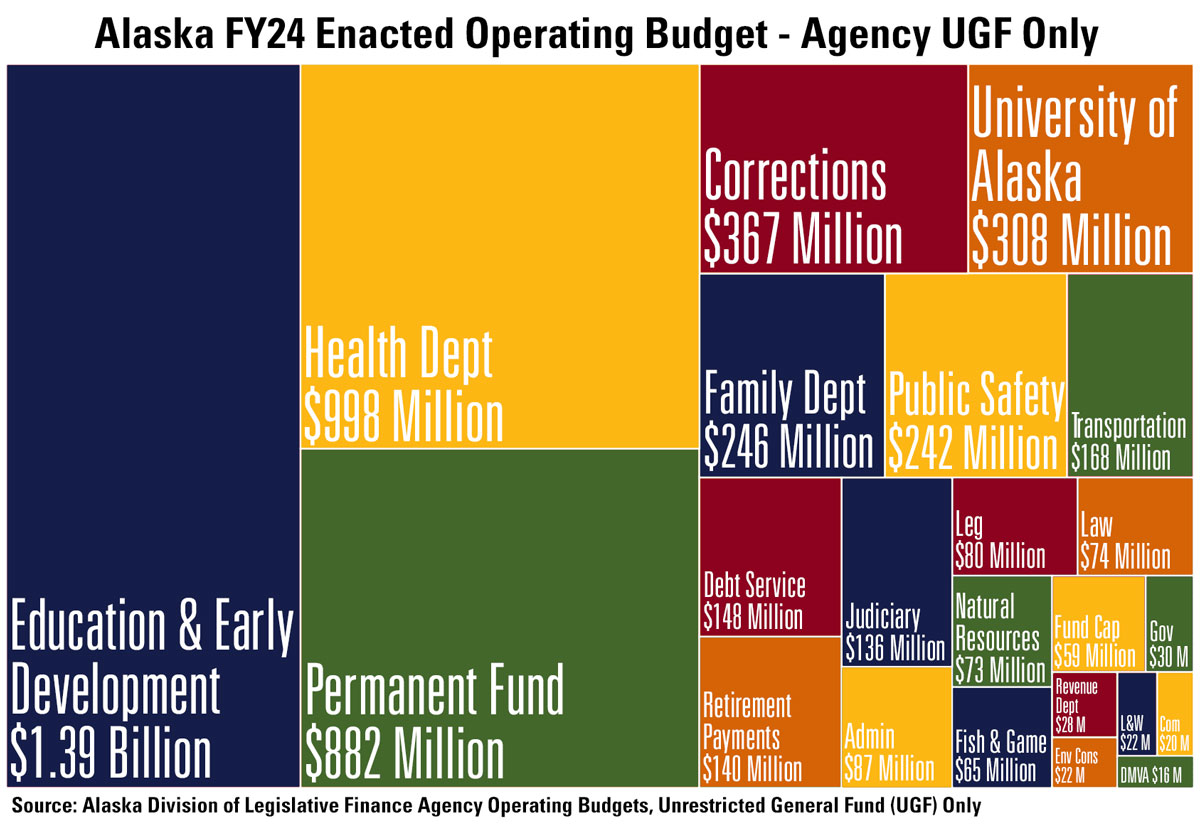

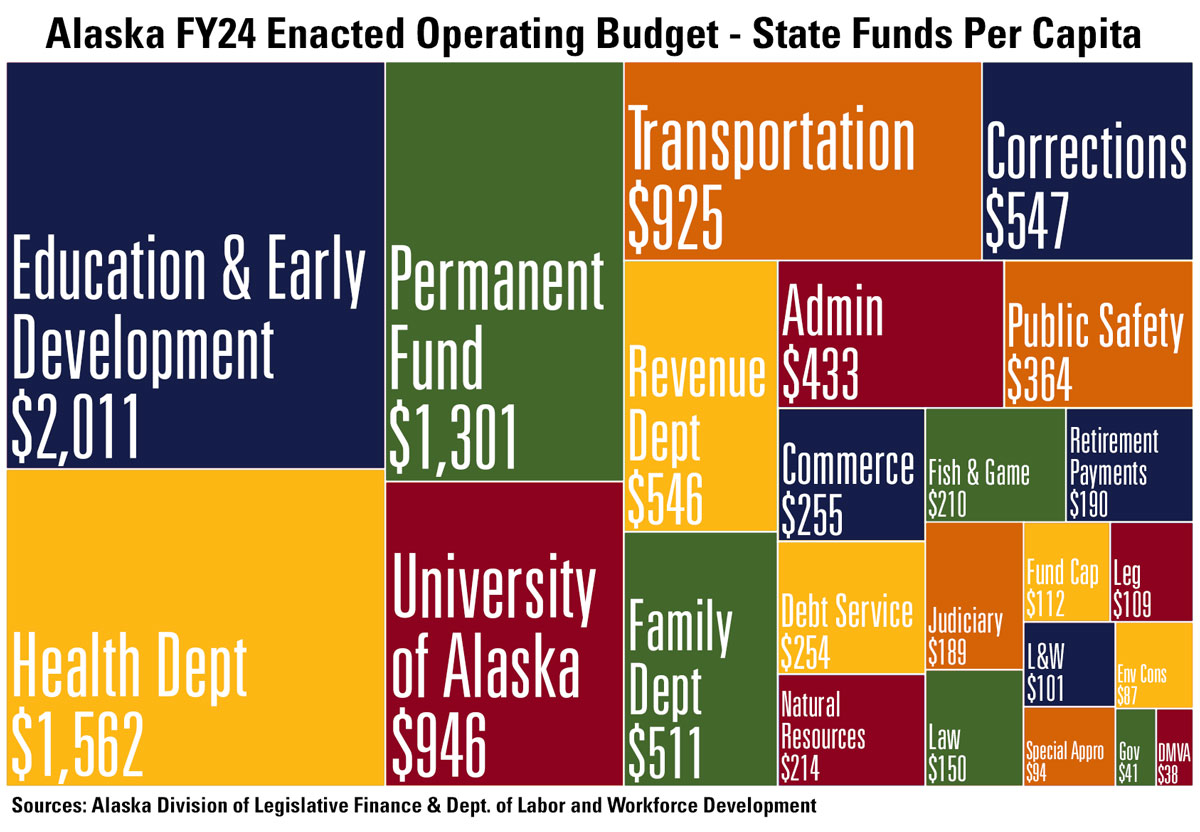

Alaska Policy Forum’s annual Budget Blocks are a simple, straightforward way to visualize how Alaska is spending its money and from which funds that money is coming. The size of each block corresponds to the amount allocated to each state agency or department in the operating budget. The more money, the larger the block. All numbers are taken straight from the fiscal year 2024 (FY24) Enacted Operating Budget agency summary provided by the Alaska Division of Legislative Finance.

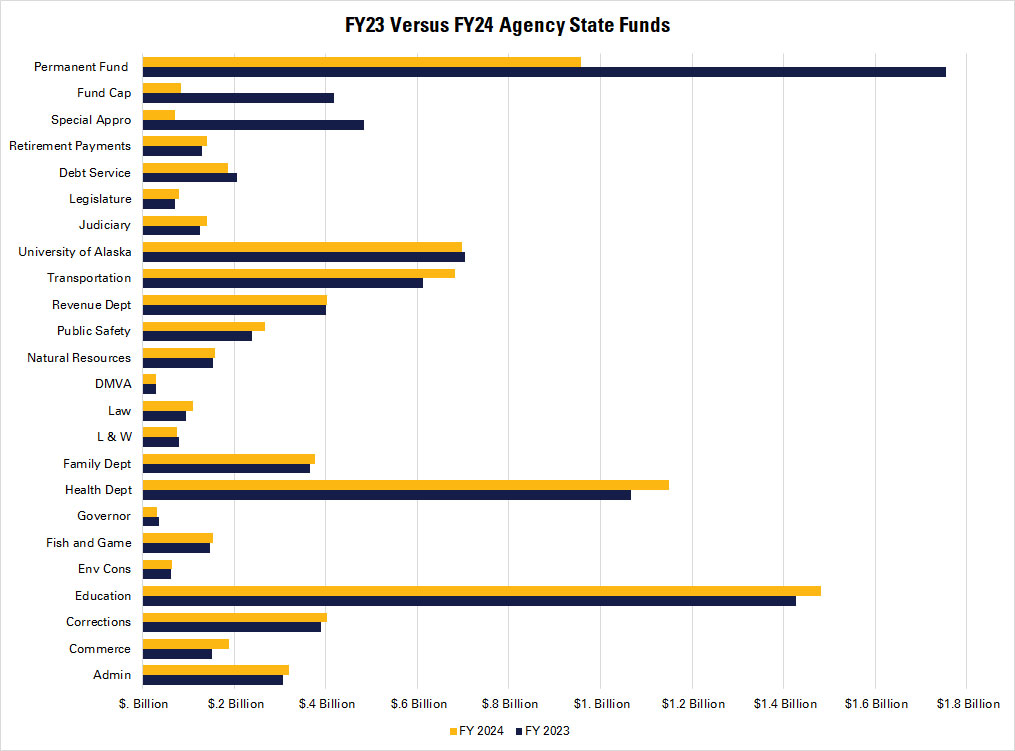

Last year, the state split the Department of Health and Social Services into two separate departments: the Department of Family and Community Services and the Department of Health. Additionally, the Fund Capitalization portion of the budget was much larger in FY23, due mainly to the addition of the Higher Education Investment Fund (HEIF), a scholarship fund. Whatever money the scholarship fund does not use by the end of the fiscal year is typically transferred into the Constitutional Budget Reserve. Last year, Alaskan legislators voted not to transfer the unused funds, keeping the HEIF as fund capitalization. This year, FY24, the Fund Capitalization portion of the budget is back to “normal.”

The Permanent Fund portion of the budget (which includes the draw from the Earnings Reserve Account [ERA]) is smaller because the FY23 appropriation — the largest in Alaska’s history — provided increased permanent fund dividends (PFDs) and an energy relief payment. The FY23 enacted budget allocated approximately 62% of the Permanent Fund block for these purposes, contrasting starkly with FY22, when 15% of the Permanent Fund block was allocated for PFDs.

Explanation of Terminology

The operating budget covers ongoing operations and expenses for the State of Alaska, or the day-to-day running of the government and state programs. According to the Office of Management and Budget (OMB), it is “annual appropriations covering ongoing operations. Appropriations are typically made for a fiscal year, with funds lapsing at the end of the fiscal year.”

Agency or Department:

- Dept. of Administration (Admin)

- Dept. of Commerce, Community, and Economic Development (Commerce)

- Dept. of Corrections

- Dept. of Education and Early Development

- Dept. of Environmental Conservation (Env Cons)

- Dept. of Fish and Game

- Office of the Governor (Gov)

- Dept. of Health

- Dept. of Family and Community Services (Family Dept)

- Dept. of Labor and Workforce Development (L & W)

- Dept. of Law

- Dept. of Military and Veterans’ Affairs (DMVA)

- Dept. of Natural Resources

- Dept. of Public Safety

- Dept. of Revenue

- Dept. of Transportation and Public Facilities (Transportation)

- University of Alaska

- Judiciary

- Legislature (Leg)

- Debt Service — The state pays back loans or bonds that have been issued for new projects.

- State Retirement Payments — Deposits to the pension fund for state and school district employee retirement obligations.

- Special Appropriations (Special Appro) — Bonds for tax credit purchases, the Alaska comprehensive insurance program, and shared taxes, such as the salmon enhancement tax and the fisheries business tax.

- Fund Capitalization (Fund Cap) — Money set aside for various funds, such as the HEIF.

- Permanent Fund — Permanent Fund ERA appropriations, which include the PFD payments.

- Unrestricted General Fund (UGF) — Non-federal money with no statutory restrictions; the legislature has the discretion to spend this money however it chooses.

- Designated General Fund (DGF) — Non-federal money that is statutorily designated for a specific purpose. According to the Alaska Division of Legislative Finance, “The legislature traditionally complies with designations, but may use these funds for any purpose at any time.”

- “Other” State Funds — Non-federal money that the legislature has limited discretion over.

- Federal Receipts — Funds received from the federal government.

The graphic titled “Agency Totals” depicts budgeted expenses to be paid from the UGF, from the DGF, from “Other” state funds, and from federal receipts.

The graphic titled “Agency State Funds Only” excludes federal receipts from the department totals and includes UGF, DGF, and “Other” state funds.

The graphic titled “UGF Only” includes only Unrestricted General Funds.

The graphic titled “State Funds per Capita” depicts all department budgeted expenditures from state funds per capita, based upon Alaska’s most recent population numbers.

The graphic titled “FY23 Versus FY24 Agency State Funds” compares FY23 budgeted state funds with FY24 budgeted state funds.