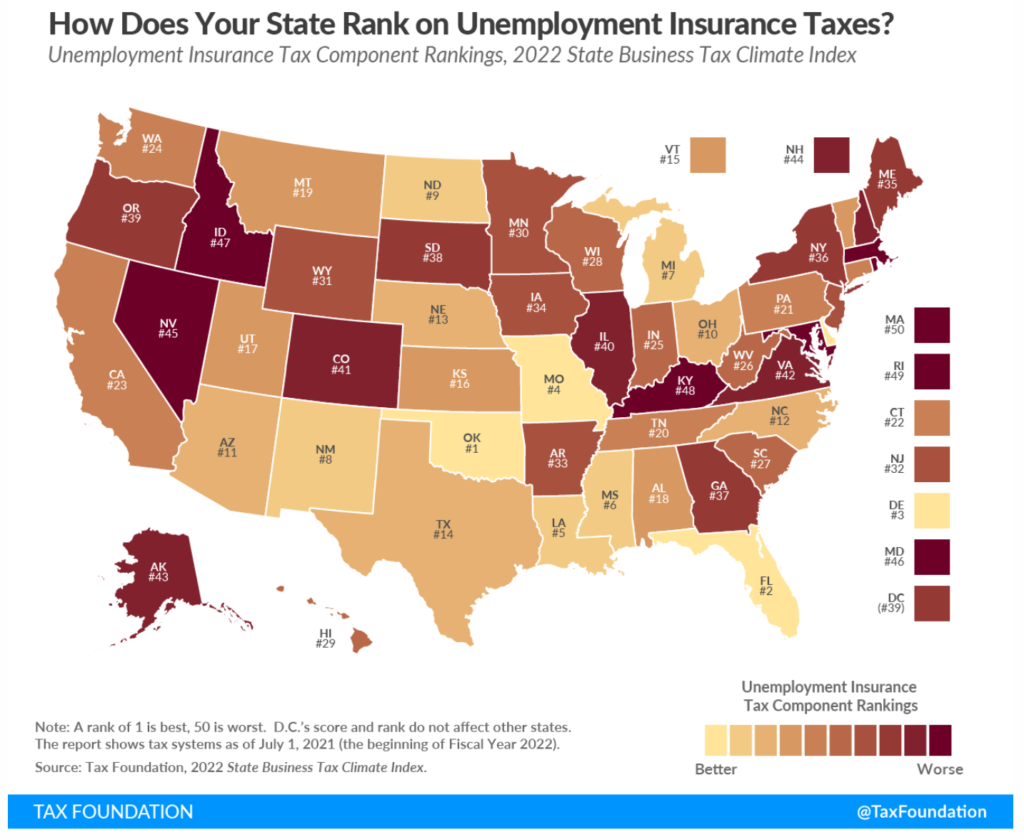

Unemployment insurance taxes (UI taxes) have significant effects on a state’s business climate, and unfortunately, Alaska’s system ranks 43rd out of 50, according to a recent report by the Tax Foundation. UI is a joint federal-state program, and all 50 states structure their UI taxes differently. Some states have very complicated systems, while others are simpler. In Alaska, employers bear the greater part of the UI tax burden, but employees also contribute to the UI fund.

Unemployment insurance taxes (UI taxes) have significant effects on a state’s business climate, and unfortunately, Alaska’s system ranks 43rd out of 50, according to a recent report by the Tax Foundation. UI is a joint federal-state program, and all 50 states structure their UI taxes differently. Some states have very complicated systems, while others are simpler. In Alaska, employers bear the greater part of the UI tax burden, but employees also contribute to the UI fund.

According to the Tax Foundation, “[t]he least-damaging unemployment insurance tax systems are those that adhere closely to the federal taxable wage base, have low minimum and maximum tax rates on each rate schedule, avoid levying surtaxes or creating benefit add-ons, and have straightforward experience formulas and charging methods. More harmful UI tax systems are those that have high minimum and maximum rates, wage bases that far exceed the federal level, complicated experience formulas and charging methods, and surtaxes or benefit add-ons that go beyond the core functions of the UI program.”

Overall, the states with the least-damaging UI tax systems are Oklahoma, Florida, Delaware, Missouri, Louisiana, and Mississippi, which have comparatively low minimum and maximum rates and wage bases at the federal level. The states scoring the worst are Massachusetts, Rhode Island, Kentucky, Idaho, and Maryland, which have high minimum and maximum rates and wage bases above the federal level.

Alaska is not far behind these lowest-scoring states.

When it comes to the way in which UI tax rates are scheduled, Alaska ranks almost last. Alaska’s wage base for UI tax rates is high, compared with other states, and the structure is complicated. In fact, the state publishes an entire “cookbook” to explain how businesses must pay their taxes. Additionally, statutory rate schedules that could be implemented at any time depending on the state of the economy are harmful to businesses.

The Tax Foundation report explains that “[o]ne of the most harmful aspects of UI taxes is that financially troubled businesses, for which layoffs may be a matter of survival, are shifted into higher tax rate schedules when they can least afford to pay a higher tax bill. Failing businesses face ever-higher UI taxes, sending them into further decline. Similarly, surtaxes imposed when UI fund reserves are low mean higher tax liability right when businesses are struggling most. Well-designed UI tax systems emphasize greater stability and predictability, especially in times of economic downturn.”

Rather than raising UI taxes on small businesses, Alaska should consider switching to a system known as UI indexing. UI indexing links the UI system to the state’s current economic condition, which would help unemployed individuals focus on reemployment when the job market is strong, allow business owners to better fill job vacancies, and stop the need to increase UI taxes on business owners and their employees.

Assisting individuals to find work, filling job vacancies, and keeping UI taxes low would be a boon for Alaska’s business climate. Now, more than ever, Alaska businesses need stability and clear skies, rather than the burgeoning clouds of higher UI taxes.