A recent report by the American Legislative Exchange Council revealed the significant financial toll of Other Post-Employment Benefit (OPEB) Liabilities, which include health insurance, life insurance, Medicare Supplemental Insurance, and more for retired public employees. Though overshadowed by the magnitude of public pension liabilities, the report finds that unfunded OPEB liabilities account for over $1 trillion nationwide, and Alaska holds almost $14 billion in unfunded OPEB liabilities. And worse – Alaska ranks 4th for growth rate in these unfunded OPEB liabilities.

A recent report by the American Legislative Exchange Council revealed the significant financial toll of Other Post-Employment Benefit (OPEB) Liabilities, which include health insurance, life insurance, Medicare Supplemental Insurance, and more for retired public employees. Though overshadowed by the magnitude of public pension liabilities, the report finds that unfunded OPEB liabilities account for over $1 trillion nationwide, and Alaska holds almost $14 billion in unfunded OPEB liabilities. And worse – Alaska ranks 4th for growth rate in these unfunded OPEB liabilities.

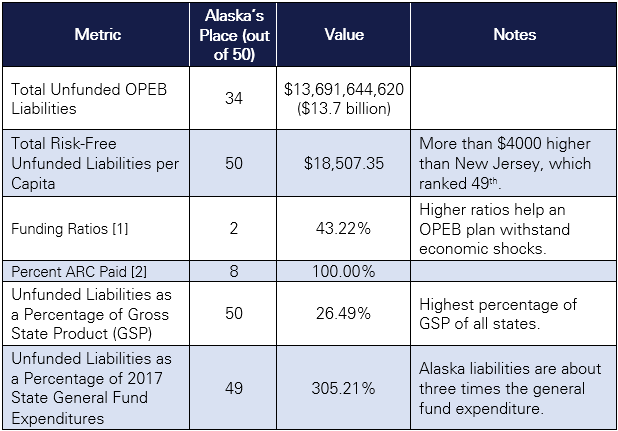

The report evaluated 132 OPEB plans from all 50 states on several metrics, including total unfunded OPEB liabilities, total risk-free unfunded liabilities per capita, funding ratio, percent of annual required contribution (ARC) paid, as a percentage of gross state product, and as a percentage of 2017 state general fund expenditures. The table summarizes how Alaska ranked for each – and the results aren’t pretty. Though Alaska is comparatively well-off in regard to OPEB funding ratio and percent ARC paid, unfunded OPEB liabilities were over three times the amount of the state’s general fund in 2017.

[1] Ratio of assets to liabilities. The valuation of unfunded liabilities uses a risk-free discount rate of 2.49% for pre-funded plans and 0.19% for plans with no assets. Consult the full report methodology for how this was calculated.

[2] Annual Required Contribution values taken from state financial documents.

Alaska’s unfunded OPEB liabilities totaled $13.7 billion, placing the state 34th in the nation. The first-place states, Nebraska and South Dakota, both have total unfunded OPEB liabilities of $0 due to implementing defined-contribution healthcare instead allowing “pay-as-you-go” plans, which let unfunded liabilities build up. Kansas, which ranked 3rd, holds $284,983 in OPEB liabilities due to phasing out of benefits during a budget crisis. In a brief comparison of states with similar population sizes, taking Wyoming and South Dakota as examples, each had OPEB liabilities of $1.5 billion and $302 million, respectively. Though undoubtedly Alaska and these small-population states have different government structures, there is certainly room to cut expenses and move towards a balanced OPEB sheet.

Total risk-free unfunded liabilities per capita measures the amount of OPEB benefits the state owes per resident of the state without funding having been allocated yet. This measure is to give some indication of the tax burden on future residents of Alaska – and unfortunately, each Alaska resident owes $18,507 in risk-free unfunded liabilities, the highest amount of any state. Notably, the next-lowest-ranked state, New Jersey, had $14,479, more than $4,000 less than Alaska. Though this could be partially explained by Alaska’s substantially smaller population, almost $20,000 per person is still a heavy burden on Alaskans and introduces uncertainty about the State’s ability to pay these liabilities when the time comes for them to be collected.

Alaska’s OPEB structure makes some attempt to bolster its ability to weather economic storms. For instance, Alaska ranked 2nd with a risk-free funding ratio of 43.22 percent. The report notes that a higher risk-free funding ratio is an indication of economic resilience. Similarly, Alaska ranked 8th for percentage of ARC paid to the OPEB liability funds, with 99.996 percent ARC paid in 2017. This means that Alaska is presumably contributing enough to be able to pay off most OPEB liabilities in the future, assuming that Alaska continues to contribute almost 100 percent of the ARC each fiscal year – a big assumption given the current economic climate.

However, several other indicators – unfunded liabilities as a percentage of gross state product (GSP) and unfunded liabilities as a percentage of 2017 state general fund expenditures – suggest that Alaska’s ability to pay unfunded OPEB liabilities is questionable. Alaska ranked dead-last in another category, with unfunded OPEB liabilities equaling 26.49 percent of Alaska’s gross state product. This metric is designed to measure the state’s ability to pay off unfunded OPEB liabilities over the long run.

In the unfunded liabilities as a percentage of 2017 state general fund expenditures category, Alaska ranked 49th with OPEB liabilities consisting of 305.21 percent of the state general fund expenditures. According to the report, this metric is designed to measure how much of the general fund would hypothetically be required to pay off Alaska’s OPEB liabilities immediately. Unfortunately, Alaska’s OPEB liabilities are more than three times the amount of the state general fund in 2017, which means that even if Alaska wished to stop funding OPEB liabilities, it would take three years of fully spending 2017-sized state general funds.

In general, Alaska government struggles to keep check on growth in debt, and OPEB liabilities are no exception. The report found that Alaska had a 13.54 percent growth rate in unfunded OPEB liabilities between 2016 and 2017. Clearly, given our current OPEB liabilities are more than three times the size of the state general fund, continuing this rate of growth would be disastrous for Alaska’s fiscal stability. If Alaska wishes to avoid Kansas’s situation, which had to cut benefits rapidly during a crisis, it would be wise to slow the rate of growth of – or even stop – the unfunded OPEB liabilities.

The conclusions of the report invariably indicate that states with “pay-as-you-go” plans struggle to keep unfunded liabilities from piling up, whereas both Nebraska and South Dakota hold no unfunded liabilities because they switched to a defined-contribution plan. As a policy recommendation, it would be reasonable and prudent for Alaska to redesign its system to a defined-contribution plan, given Alaska’s current fiscal situation and the stunning successes of other states in reducing their unfunded OPEB liabilities to zero.